Timesheet labour recovery

Whenever a timesheet entry is recorded for a person for a job or a work order, it is possible to have the value of this work deducted (or recovered) from your wages expenses and allocated to either the job or a work order.

This feature provides a method of automatically recovering general or production wages costs and apportioning them to the actual items or jobs on which the labour was expended.

What is the overall effect and purpose?

The purpose of being able to recover wages from your P&L is two-fold:

- Wages expenses can be capitalised into WIP until the job or work order is finished (only if the job has been flagged as having a Work in Progress account). For the duration of that job or work order, the total cost of labour from timesheets is deducted from your P&L and put into Work in progress.

- Wages can be reported as those which are productive versus those which are overhead. Once all productive wages are recovered onto jobs or work orders, the wages that are left must be non-productive overheads. You can examine the remaining overheads and tune your job costs to ensure that, for production staff, all wages that are paid are ultimately apportioned to jobs or work orders. The net result will be that all wages costs paid will have been fully recovered over a selected period.

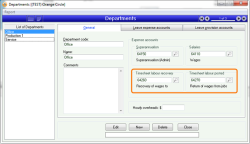

Key setup

In the example below, when a timesheet is entered for Phil, $65 per hour entered will be deducted from account 64260 and stored there until the job or work order on which he worked has been finished.

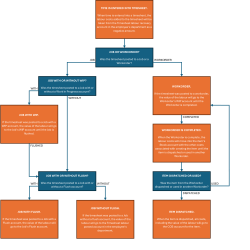

When do labour costs get accumulated (recovered) from your P&L

When a timesheet is entered against a job or a work order, the employee’s departmental Timesheet labour recovery account is credited (decreases) and the job/work order’s Work in Progress G/L account is debited (increases) by the cost of that labour (see below discussions relating to cost).

What is the cost of the labour recovery?

The amount recovered from wages is determined by the following, in order:

- If a timesheet entry has specifically recorded a job rate on any of the lines, this rate will be used

- If an employee has a specific job cost rate entered against any of their Pay items in their employee information, then this will be the hourly rate that is used

- If none of the above rules apply, the employee’s Job cost rate in the Pay details section of their employee information will be used

When do the costs get returned to your P&L?

- When a job is flushed (see discussions on job costing)

- If the job has a Job cost flush account associated with it (job Setup tab), then the accumulated labour costs from timesheets are posted to this account as at the flush date

- If the job does not have a flush account associated with it, then the accumulated labour costs are posted to the employee’s departmental Timesheet labour posted account

- When a work order is completed, the accumulated labour costs from timesheets are added to the item’s total cost in inventory. Labour is effectively capitalised until the item is sold

Example setup and analysis

Many customers have their chart of accounts set up in such a way that makes it clearly visible which accounts are being credited and debited, rather than having all transactions post to the same wages account.

For example, below is a typical chart of accounts setup for this:

|

Account code |

Account Name |

Balance |

|

|---|---|---|---|

|

50100 |

Wages for production |

$500,000 |

(normal wages expense account) |

|

50101 |

Wages recovered onto jobs/workorders |

$450,000 |

(Manufacturing labour expenses) |

|

50102 |

Wages returned from jobs |

$300,000 |

(Manufacturing labour C.O.S.) |

The example above shows that total wages paid to production employees (via payroll) is $500,000 but only $450,000 has been recovered onto jobs and work orders (put into WIP or redistributed to inventory). This indicates that $50,000 has not been recovered via timesheets which could either mean that staff are working on tasks that are not reflected in timesheets or that your job cost rate is not sufficient to cover actual wages.

In the example shown, only $300,000 have been returned as wages costs to the P&L – the remainder (from the $450k recovered) may either still be in Work in progress or may have been recovered onto work orders in which case the costs will never be returned to this part of the P&L. Instead, these costs will be debited to a product’s cost of sales account.

Further information

Job cost rates should typically be 15%-20% above an employee’s hourly rate to cover superannuation, annual leave, payroll tax, workers’ compensation, etc. This feature has been highlighted in an article which may explain the concept in an easier to read manner.